Whether you love it or you hate it, Facebook is pretty much everywhere.

Personally, I’ve wanted to quit it so many times, but like the majority of us, I just can’t take the plunge. It has become the primary way that I keep in touch with far too many people. I’ve completely lost touch with several old friends simply because they don’t use Facebook.

I first got a Facebook account back in 2006 and was one of the first people to have one. Back then, it was only open to students at specific colleges and universities, and required an official school email address to create an account.

I used to sort of brag about this, but now I can’t help but roll my eyes at the thought. I don’t even want to think about how many hours I’ve wasted on Facebook over all these years…

One of the things that I do like about Facebook, however, is it’s “memories” feature (which used to be called “on this day”). I mean, 13 years of my life have been documented in this one profile, so there’s a lot to remember!

It has been great for reminders of birthdays, anniversaries and other important events.

But sometimes it reminds me of things that I’d rather forget about.

For the most part though, the memories that pop up are all things that I have already long forgotten about. Becoming friends with someone I’m no longer in touch with. Comments that I no longer have any context for. Status updates that no longer make any sense.

Recently, a memory popped up that when I saw it, I knew I had to write a post about it.

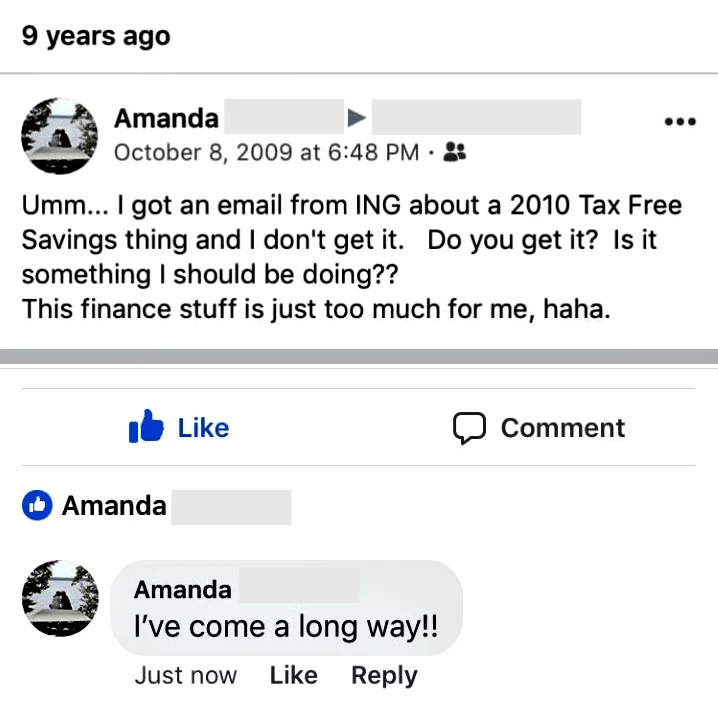

On October 8, 2009, I left this comment on my sister’s Facebook page:

“Umm… I got an email from ING about a 2010 Tax Free Savings thing

and I don’t get it. Do you get it? Is it something I should be doing??

This finance stuff is just too much for me, haha.”

Before devouring all the content that personal finance bloggers have provided me since discovering them roughly 7 years ago, my financial knowledge was pretty basic.

I was really good at saving money, but that’s about all I knew.

At one point, I had $10,000 sitting in a plain old bank account, where it earned 2 cents a month in interest. So even though I had money, my money was not working for me.

My older sister was much more into personal finance than I was. She introduced me to no-fee banking, my first budget spreadsheets, and walked me through this new thing called a Tax Free Savings Account.

I couldn’t help but laugh, and commented on the memory “I’ve come a long way!!”

And it’s true.

I really have come a long way!

Okay, so my finances are much worse off now then they were back in 2009. (I had just graduated and was only a few months into my first “real” job.)

And that $10,000 in savings has long been replaced by $100,000 of debt. Ugh.

But my financial literacy has drastically improved.

I understand money so much more now than I ever have before. Even though I don’t have as much of it.

I went from not even understanding the concept of a Tax Free Savings Account to encouraging strangers on the internet to open one.

Psst! Use my Orange Key “32872052S1” and get a $50 bonus!

In addition to my TFSA, I now also have a Registered Retirement Savings Plan (RRSP), a Locked-In Retirement Account (LIRA) and a small pension with a previous employer.

For 2 years, I tracked every cent I made or spent so that I could actually see where my money was going, not just where I thought it was. I could identify exactly where I was overspending, and instead focus more on my priorities (like paying down my debt).

Speaking of debt, I’ve paid off over $40,000 in debt, but still have nearly $90,000 left to pay.

I now run a semi-successful personal finance blog, where people turn to me for advice, instead of me turning my sister over the most basic questions.

A lot sure has changed for me since that Facebook-documented day back in 2009!

It’s Easy to Forget How Far You’ve Come

It’s so easy to forget about how far you’ve come, especially when there’s still so much further left to go.

I’m guilty of falling into this mindset, too.

Just a few paragraphs ago I wrote: “I’ve paid off $40,000 of debt, but I still have $90,000 to pay.” I should be celebrating that $40,000 instead of immediately dismissing my progress and hard work within the same sentence.

[click_to_tweet tweet=”Always concentrate on how far you have come, rather than how far you have left to go.” quote=”Always concentrate on how far you have come, rather than how far you have left to go. ” theme=”style3″]

How Far Have You Come?

With the end of the year quickly approaching, people naturally start to look back and reflect over the last 12-months.

Where were you at this time last year? What have you accomplished? What are you proud of? What positive habits or changes did you make? What worked for you? And what didn’t?

Take the time to really think about this. Maybe even try writing it down.

Think about your finances, your career, your side hustle, your passions, your hobbies, your social life, your relationships, your family, your home, your health, your mental well-being, your confidence, your skills, your progress, your mindset, your outlook on life.

And then go further.

How have you changed in the last 5 years? 10 years? 20 years?

Need Some Inspiration?

If you’re feeling stuck and/or in need of some inspiration, here are some articles I highly recommend checking out:

“If someone told me in December 2014 that this would be my life in August 2017, I would have laughed in their face.” – The Importance of Looking at How Far You’ve Come by Amanda Page

“As much as I would love to say that progress is a journey that begins with a single step, it’s more a combination of Chutes and Ladders mixed with one of the old-fashioned dance steps diagrams where the steps become virtually untraceable by the end.” – To Anyone Who is Learning That Progress Isn’t a Line by Penny, She Picks Up Pennies

“Instead of focusing on your past behaviours and how “wrong” they were, focus on what they can teach you for the future, and use that information to put plans or goals in place.” – Regretting Your Past Money “Mistakes” Isn’t Helpful by Desirae, Half Banked

“The bright-side, though? You are totally going to be ahead of the game even though you think you’re going to be behind.” – You’re Not As Behind As You Think by Alyssa, Mixed Up Money

“Money is all too often talked about in voices tinged with doom and gloom. You can look at your accounts and feel stressed or inadequate. But most likely, there is something that you did this month that was a financial win.” – The Three Money Questions To Ask Yourself Each Month To Stay On Track by Kara, Bravely

“You’re not going to wake up a millionaire overnight or at your goal weight tomorrow, but everything you want in life? Your dream life? IT IS POSSIBLE. You’re not going to wake up a millionaire overnight or at your goal weight tomorrow, but everything you want in life? Your dream life? IT IS POSSIBLE.” – Two Tips to Achieve your Impossible Goals by Steph, Simplistic Steph

“I’m reviewing what I’ve done in the past five years as a way to prove to myself that I can do the things I once thought were so out of reach.” – When You Set Your Mind to Something by Amanda Page

YOUR TURN: What did you use to think was impossible for you that became possible? How has your mindset changed over time? What is going in the right direction for you that you can continue to do? Please leave a comment below!

Amanda Kay, the founder of My Life, I Guess, provides valuable career advice and support for anyone striving to make a living and, more importantly, make a life. Whether it's navigating job searches, learning new skills, overcoming unemployment, or dealing with debt, My Life, I Guess has been a go-to resource for career guidance and financial stability since 2013. Amanda's expertise and relatable approach have been featured in trusted publications such as MSN, Credit.com, Yahoo! Finance, the Ladders and Fairygodboss.

Beautifully said, especially this time of year when we’re all thinking about what’s coming next for our goals versus slowing down to acknowledge the awesome things we’ve already done.

Thanks, Angela! It’s exciting to look ahead, but valuable to look back first.

I used to think earning 60k and 80k was impossible. Took time but I broke both limits – now to crack six figures!

Such a good reminder to stop and look back. I need that right now!

Yay! I’m glad I could help. And hope that I too can crack into 6-figures one day 🙂

WOAH- so cool to see my article on your site. This is crazy inspiring. It’s so easy to just stare at how much further we have to go, instead of appreciating what we’ve done!

This is exactly what I’ve been talking about for the last few weeks! I’ve come so far in the last few years, even though sometimes it doesn’t feel that way. But when I get glimpses like that of my past on my FB, I just smile and laugh, cause I was a hot mess before! Lol

I was looking at some old g-chats a few months ago and saw how I used to talk money with my coworker. I didn’t know what a health insurance deductible was 8 years ago!

I think it’s important to have these conversations, because sometimes it seems like money is effortless for some people. We’ve all gotta start somewhere.

This is such a great reminder. I always reach a goal and then immediately on to the next, but the truth is, it’s important to take a moment and reflect on how much we’ve accomplished and learned. Great “inspiration” links–thanks!

Reading finance blogs like this has helped me come a long way too. I’m so happy that I started reading them. Thank you for including links to more places that I’ll have to start reading. One day I’d like to look back at this moment and realize how much progress I make going forward.

Yes! This year I had a goal to put 10k towards my student loans… It didn’t happen. I put just over 7k towards them, and for awhile, I was really frustrated with myself. But then, I realized, the fact that I was in a position to aggressively pay down that much debt BEFORE my grace period ended is amazing! And I should be celebrating, not groaning.

The past is dry cement.